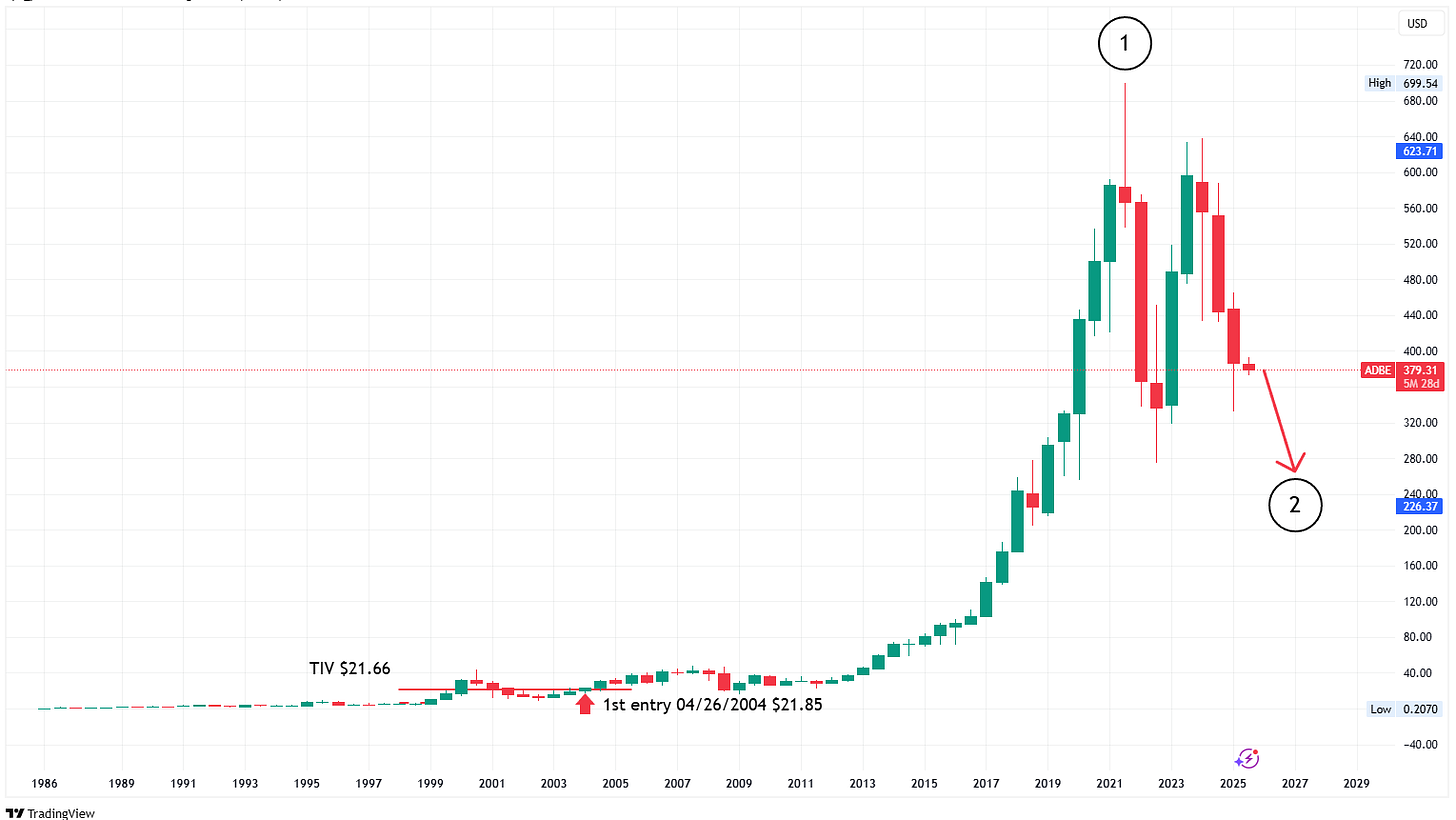

Adobe ($ADBE): Don’t Be Fooled — The Cycle Isn’t Done Falling Yet

While investors cheer rebounds and headlines, the TIV model tells a different story: Adobe could still drop as low as $265 before its real bottom is in.

🏢 Company Profile

Adobe Inc. is a cornerstone of the digital creative world. From Photoshop and Illustrator to Acrobat and Premiere, its software powers creative work across industries. The company has expanded into cloud-based platforms like Creative Cloud and Document Cloud, and it's entering the generative AI space with Firefly and Sensei.

But even great companies can become poor investments if you enter at the wrong point in the cycle.

And right now, Adobe is not yet at its optimal buy point, according to the Technical Intrinsic Value (TIV) model.

📉 Where Are We in the Cycle?

“Timing isn’t guessing. It’s reading the cycle.” — Nicolau Primavera Carvalho

Adobe completed a powerful wave which took the stock up to December 2021 highs and since then entered a broad correction phase — what we define as Wave 2 in our TIV cycle.

Many believe the recent bounce signals a bottom.

We disagree.

Based on the TIV model:

The current correction is incomplete.

Wave 2 has not fully retraced.

Trying to buy early in Wave 2 is like catching a falling knife — unnecessary and avoidable.

Technical Analysis

Market cycle applying TIV (Technical Intrinsic Value model)

Was Adobe a good investment until now???

1st entry 👌

Adobe returns - 1531.44% CAGR (14.52%)

S&P 500 returns - 450.41% CAGR (9.01%)

Duration of the investment 21 years

🔍 The Illusion of Strength

Many investors are interpreting the recent rebound as a sign of strength. But what looks like a breakout may simply be a classic Wave B bounce — a trap within the broader correction.

This is how investors lose patience — and capital.

“The most dangerous point in a cycle is when the market gives you false hope.”

🚫 Why We’re Not Buying Yet

Until Adobe confirms a final low — ideally near the $265 region — we:

Remain on the sidelines

Avoid premature entries

Let the cycle mature

“This isn’t fear. It’s strategic patience.”

The TIV model teaches us to wait for technical confirmation of Wave 3 before initiating any position.

🚨 Trade Setup Watchlist

🔔 No Trade Yet

If Adobe ($ADBE) drops into the $265 range and begins to show structural reversal patterns, we’ll prepare for a Wave 3 entry — the strongest phase in the cycle.

Until then, no confirmation, no position.

🧠 Final Thoughts

This is where the TIV model proves its edge.

Most investors react to headlines. We follow the cycle.

Even elite companies like Adobe go through major corrections — and that’s not a bad thing. It’s what creates the opportunity.

While others chase rebounds, we wait for value within the cycle.

Discipline is alpha.

$265 is the level to watch.

Patience is positioning.

🔁 Share this with investors who still believe the bottom is in. Let them see the cycle for what it is — not what they want it to be.

Wishing you profitable decisions,

The Symphony of Stock Picking