The Final Stage: What Oracle’s Chart Tells Us About Market Cycles

A Real Example of How to Identify the End of a Trend Before It Breaks

📍Intro:

When people ask me how to know when to get out of a stock, I often reply:

“Watch the cycle — not the hype.”

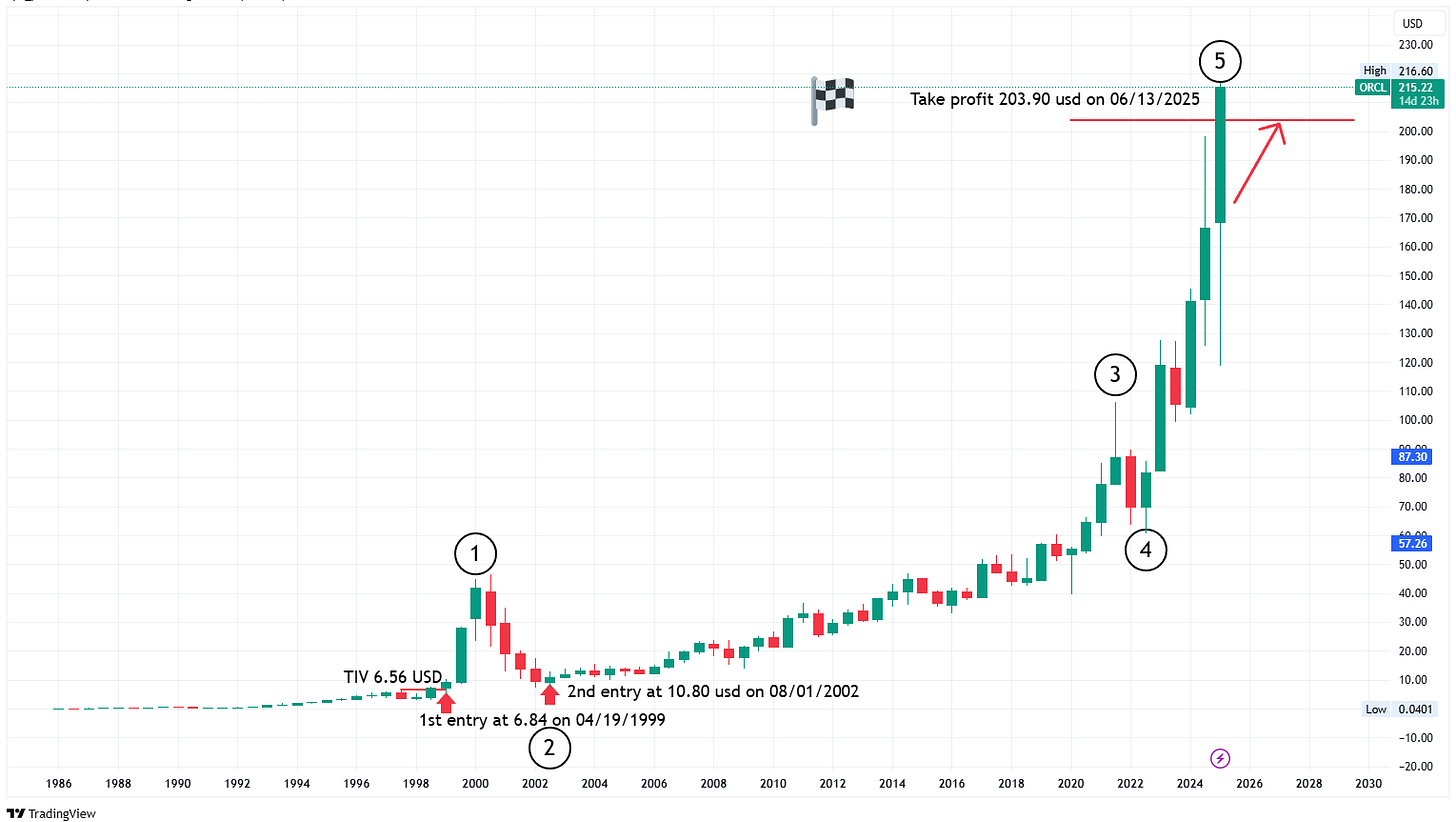

Oracle just completed a textbook full cycle, and if you follow my approach, you’ll understand why you should have exited at 203.90 usd top of wave 5.

Last week, I published the full market cycle of Oracle.

In that analysis, I projected that the final stage — Wave 5 — would complete at $203.90 USD.

That level marked the top of the cycle, and the structure has since confirmed it.

📖 You can read the full article here:

Now that the cycle is complete, it’s time to update the chart and assess the trade.

Oracle ($ORCL) has officially completed its full 5-wave structure — just as projected, with Wave 5 topping at $203.90.

In this post, I’ll break down:

📊 How the updated chart looks post-peak

💰 The actual return on this investment

📈 How it compares to the S&P 500 over the same period

🔁 And what the cycle teaches us about timing entries and exits with precision

This is more than just a technical win — it’s a clear example of what happens when you follow the full cycle instead of chasing hype.

📖 Let’s dive into the results.

Technical Analysis

Market cycle applying TIV (Technical Intrinsic Value model)

Was Oracle a good investment?

1st entry 👌

ORCL return - 3.081,08 % CAGR (14.09%)

S&P 500 return - 347.65 %% CAGR (4.91%)

Duration of the investment 26 years

2nd entry 👌

ORCL return - 2.050,05 % CAGR (14.71%)

S&P 500 return - 555,64 %% CAGR (8.11%)

Duration of the investment 22 years

🧾 Conclusion: The Power of Full-Cycle Discipline

As I mentioned in the previous article about Oracle, whether you entered on the first entry or on the second, the result was exceptional — with returns that far outperformed the S&P 500 over the same period.

Now, with the position officially closed on June 13, 2025, some of you might ask:

“If we correctly predicted the top of Wave 5, why not open a short position?”

The answer is simple:

👉 I don’t short stocks.

And more importantly:

👉 Just because Wave 5 has peaked doesn’t mean the correction will begin immediately.

Instead, once the position is closed, I step aside. I don’t force trades. I wait patiently for the correction to unfold — which often takes time — and only after the next cycle begins to build will I consider a new entry.

That moment might be years away.

In the meantime, the proceeds from Oracle will be reallocated into the next opportunity — another stock that is either in early accumulation or building a new wave structure with asymmetric upside.

That’s the discipline of full-cycle investing.

That’s the core of my strategy.

Wishing you profitable decisions,

The Symphony of Stock Picking